The world's largest online professional carpet cleaning community.

TMF Community is made for Professional cleaning companies who want to grow their business from various services; carpet cleaning, upholstery cleaning, tile grout cleaning, oriental rug washing and overall truckmount and carpet cleaning portable discussions.

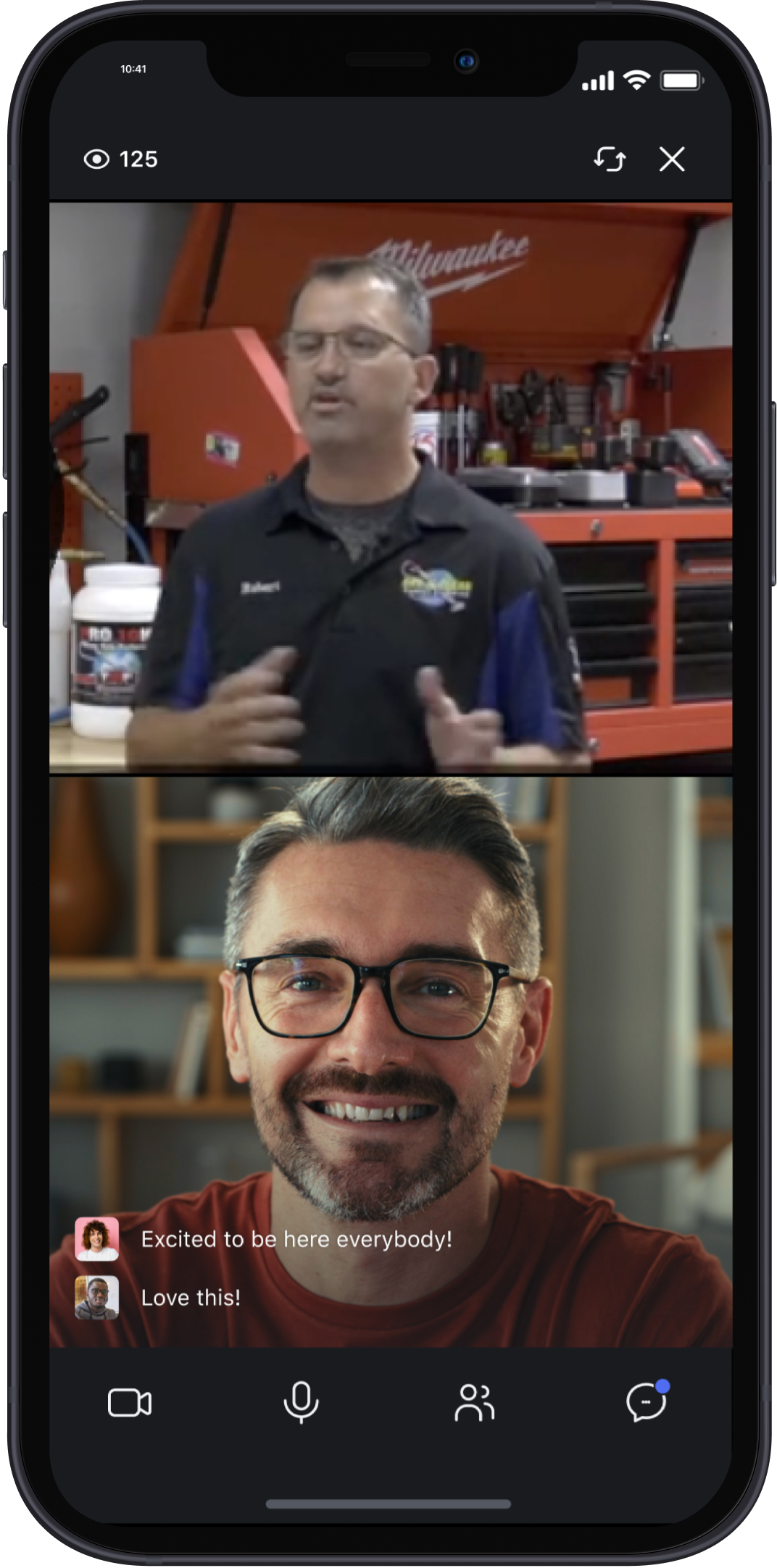

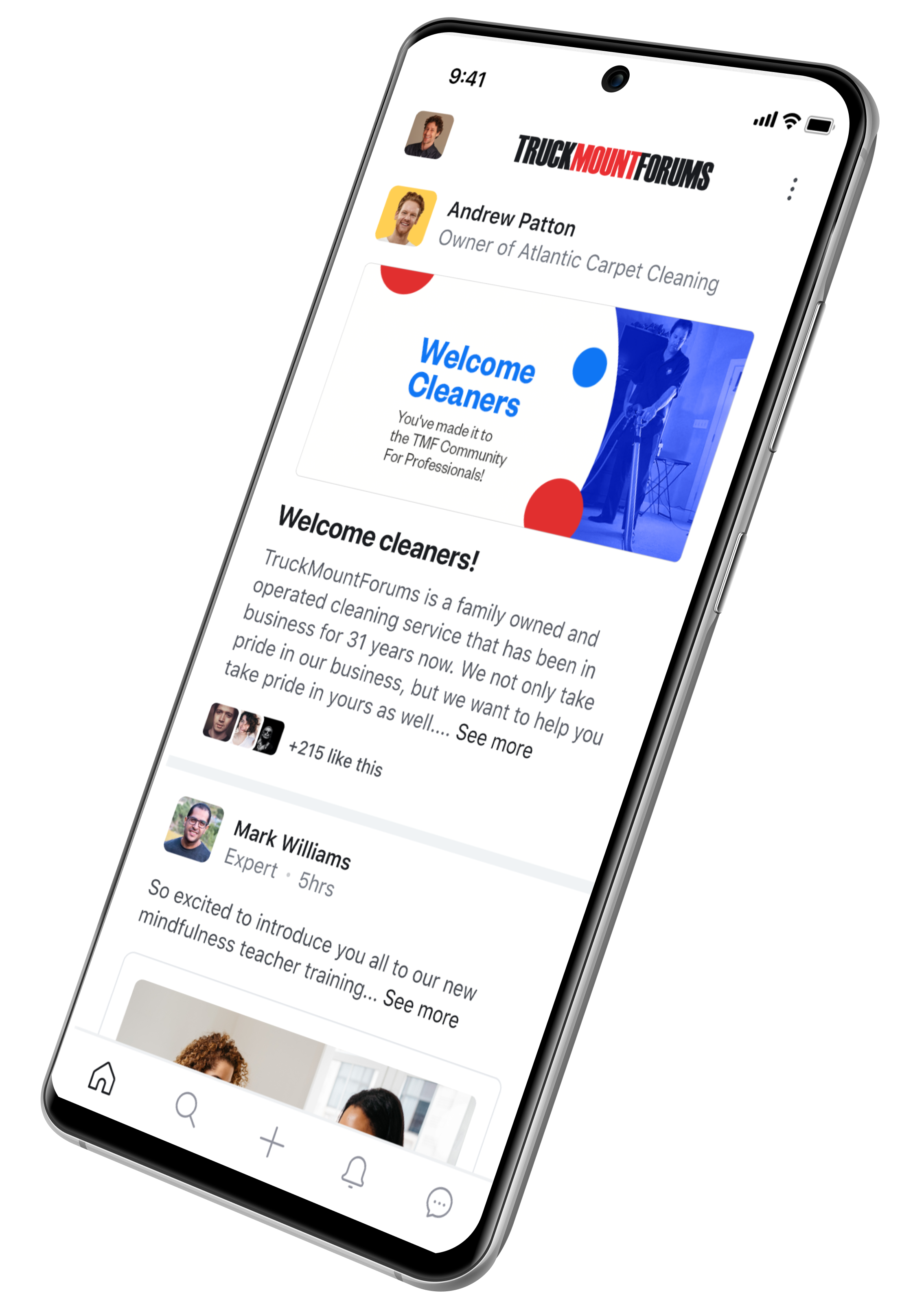

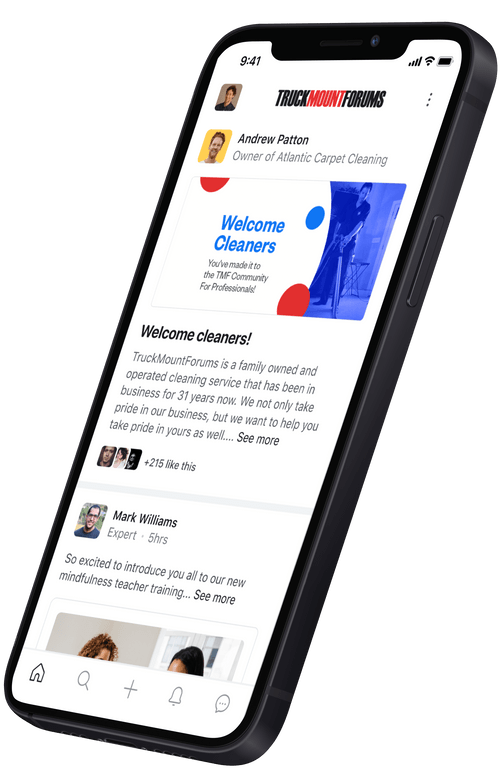

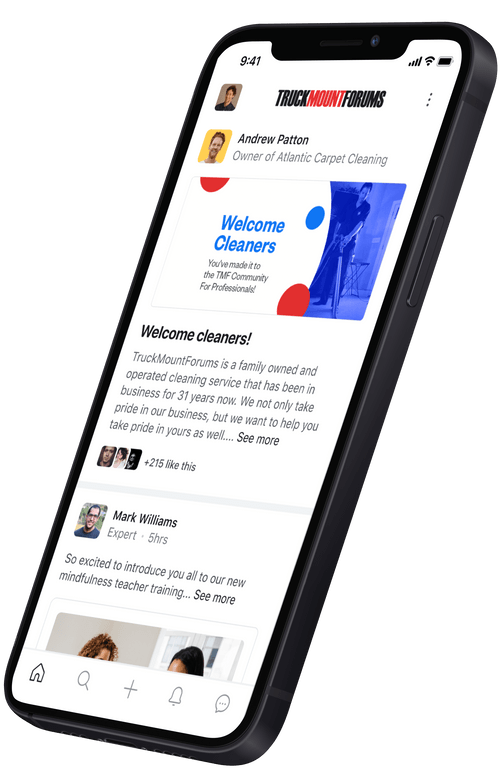

The brand new v2 TMF community app

Live trainings, q&a, carpet cleaning chemical discounts and more!

The TMF Store app

Get the best deals on carpet cleaning equipment and carpet cleaning chemicals from Truck Mount Forums!

Best Pre-Sprays

Best Spot Remover

Best Pet Treatment

Best Cleaning Equipment

6500+ ⭐️⭐️⭐️⭐️⭐️ reviews

See what industry carpet cleaning professionals are saying about TMF carpet cleaning chemicals

Best for those nasty areas!

The name fits its purpose. This is the best stuff for those really bad areas of carpet.

The Cadillac

I've tried several wands and nothing compares. I was hesitant about the price but after running one and comparing it to other wands, a TMF swivel is far superior and all we'll use from here on out. Worth every penny.

Great low moisture tool!

I've used this tool for about 8 months and feel confident I'll be using it for much longer as it's in perfect shape still. I purchased it off of a TMF ad, and I'm really happy we did. Doesn't over wet material and is very user friendly on the wrists due to it having a swivel cuff.

Very efficient tile and grout cleaner.

Effective on all kinds of flooring just reduce or raise the dilution rate accordingly. Thank you Rob for the excellent invention.

Robs Chems Rock

My initial thought was that how could a carpet cleaner’s chemicals be better than name brands. But after trying a few and using Bio Pro as my main prespray, I have been getting superior results. For the Nasty carpets I tried Frog Nasty as a booster today for the first time. In areas I used to have to go over twice, one cleaning is all that it took. What a time saver! THANK YOU ROB!!!

UV light

This UV light works beautifully and saves time by not having to change batteries every night.

Rob wins again!

We had a nasty dirty concrete floor in a basement and Concrete Master saved the day. After we were finished you could have eaten off the floor.

Smells as good as it works

I have always used Black Label. I just started a HUGE College facility and I’m using Blue Label! Walking down the halls, I can hear students and faculty talking about how wonderful the smell is!! I just smile and move on to the next 1700 units!!! Crazy job but Blue Label is making a difference!

Robs Chems Rock

My initial thought was that how could a carpet cleaner’s chemicals be better than name brands. But after trying a few and using Bio Pro as my main prespray, I have been getting superior results. For the Nasty carpets I tried Frog Nasty as a booster today for the first time. In areas I used to have to go over twice, one cleaning is all that it took. What a time saver! THANK YOU ROB!!!

UV light

This UV light works beautifully and saves time by not having to change batteries every night.

Rob wins again!

We had a nasty dirty concrete floor in a basement and Concrete Master saved the day. After we were finished you could have eaten off the floor.

Smells as good as it works

I have always used Black Label. I just started a HUGE College facility and I’m using Blue Label! Walking down the halls, I can hear students and faculty talking about how wonderful the smell is!! I just smile and move on to the next 1700 units!!! Crazy job but Blue Label is making a difference!

Best for those nasty areas!

The name fits its purpose. This is the best stuff for those really bad areas of carpet.

The Cadillac

I've tried several wands and nothing compares. I was hesitant about the price but after running one and comparing it to other wands, a TMF swivel is far superior and all we'll use from here on out. Worth every penny.

Great low moisture tool!

I've used this tool for about 8 months and feel confident I'll be using it for much longer as it's in perfect shape still. I purchased it off of a TMF ad, and I'm really happy we did. Doesn't over wet material and is very user friendly on the wrists due to it having a swivel cuff.

Very efficient tile and grout cleaner.

Effective on all kinds of flooring just reduce or raise the dilution rate accordingly. Thank you Rob for the excellent invention.